Category: Mortgage

Mortgage Forbearance During Financial Crises

In times of financial distress, some homeowners can seek relief from monthly payments through mortgage forbearance programs. These programs can be helpful during rough times, but they must be handled with care. Let’s take a closer look at mortgage forbearance. How mortgage forbearance works Mortgage companies offer forbearance to borrowers

FAQs on Financing Your First Home

Getting your first home mortgage can be intimidating. Let’s eliminate fear of the unknown by answering some common questions. Q: Can I get a mortgage even though I have bad credit? Yes, though you’ll get better interest rates with a good credit rating. With conventional financing you can get a

Mortgage Prepayment and Late Payment Penalties

Homeowners face stiff penalties both for paying off their mortgages early and for making their monthly payments late. Here’s how mortgage prepayment and late payment penalties work and what you can do to avoid them. The cost of mortgage prepayment Prepayment penalties are charged when a borrower pays all or

How Getting a Mortgage Affects Your Credit Score

Experts stress the importance of maintaining good credit before you apply for a mortgage. But after you get that mortgage and close on a new house, what happens to your credit score? Keep working hard on your credit score It takes years of acquiring and faithfully paying off smaller amounts

Should You Pay Mortgage Points?

One strategy for lowering your mortgage interest rate and the overall cost of your loan is to pay mortgage points up front. What are mortgage points, how can paying them save you money, and when is that the right choice for you? What are mortgage points? A point is simply

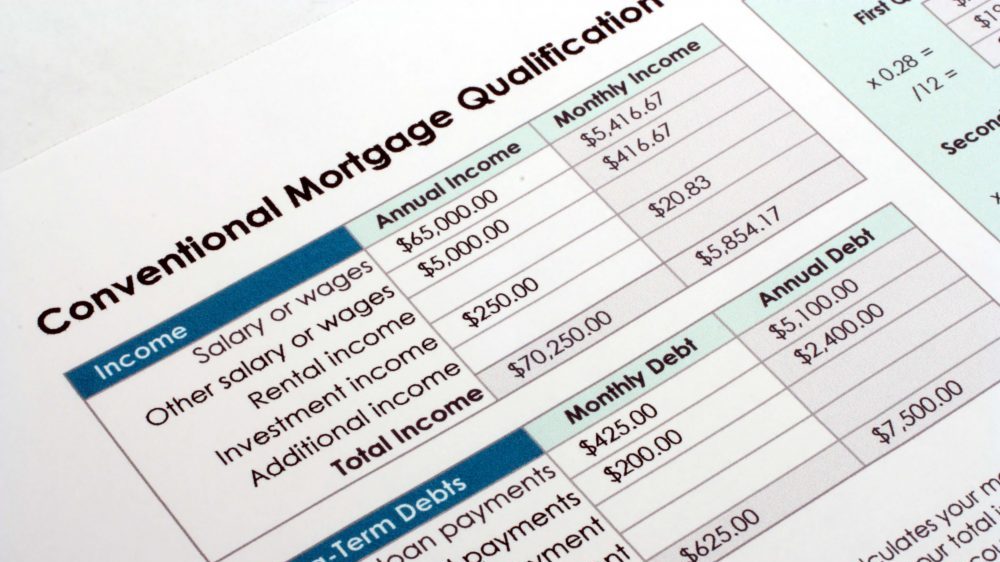

What to Provide for Mortgage Pre Approval

If you’re in the market for a home, particularly your first one, it’s advisable to meet with a mortgage lender at the beginning of the process. Having a mortgage pre approval letter from a lender will save time for you, your agent and the seller. What do you need to

What To Do About a Mortgage Application Denial

It’s a shock when your application for a mortgage is declined. You are excited about owning a home, but the opportunity gets snatched away. What can you do about a mortgage application denial? First things first If your mortgage application is denied, ask the lender why. Under federal law, you

How to Build a Strong Credit History in Four Steps

Securing a good interest rate and qualifying for a home require a good credit report. That’s easier said than done, especially for today’s millennials who are often weighed down by student loan debt. Here’s a four-step approach to building a strong credit history. Types of credit Debt falls into two

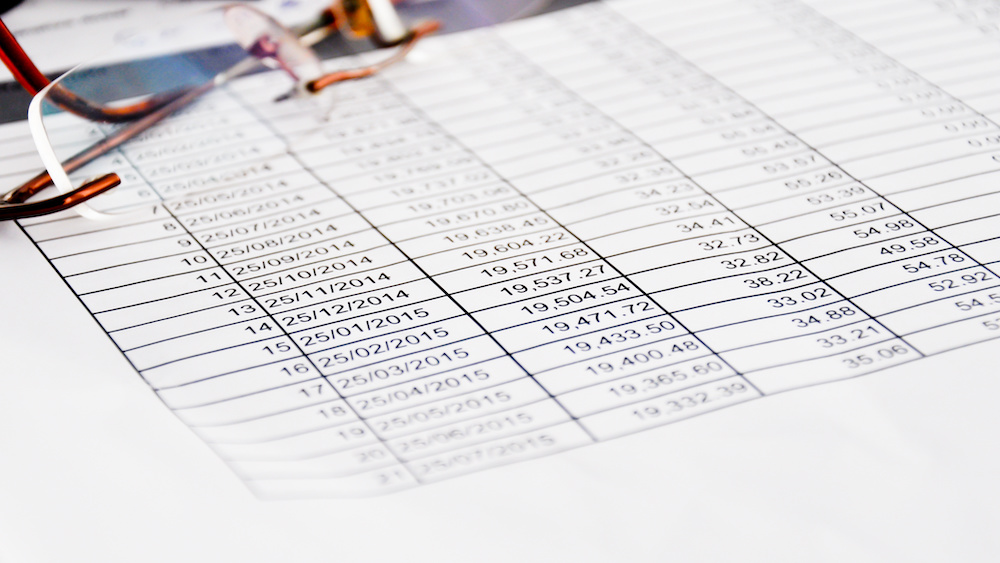

Are Biweekly Mortgage Payments Worthwhile?

If you make only the monthly payments set by your mortgage company, in the end, you will pay a significant amount of interest. Making biweekly mortgage payments can save you money by reducing interest and shortening the term of the loan. Here’s how. Chipping away a little at a time

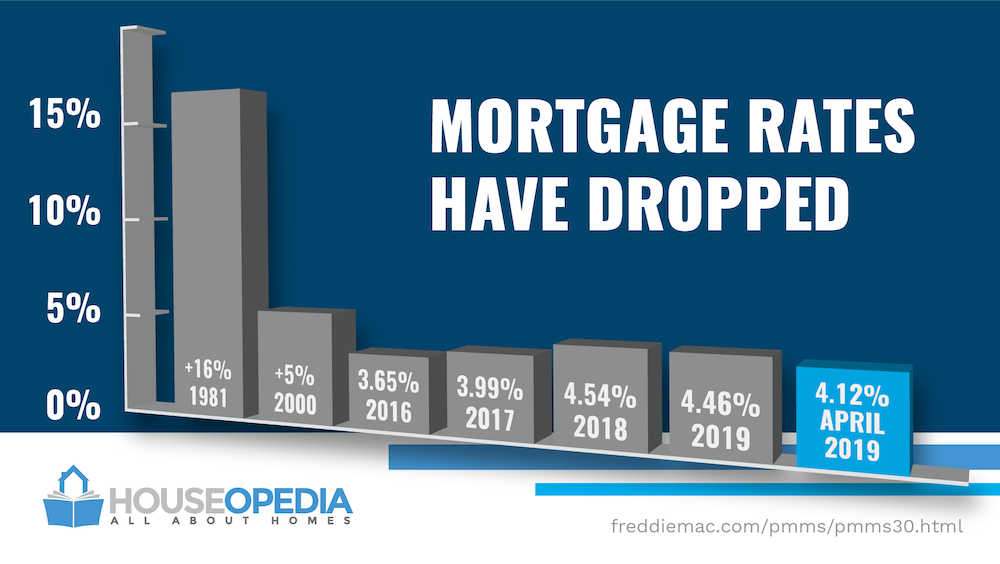

Mortgage Rates Are Still At Historic Lows

It’s true. Mortgage rates had risen slightly over the past several months, but is that reason enough to halt your search for a new home? Not likely, because mortgage rates have since dropped and are still at historic lows. It’s a Numbers Game Simply put, the lower your rate, the

Home Buying Help for Military and First Responders

If you — or a member of your immediate family — are an emergency first responder or a member of the military — you could be eligible for specialized programs aimed at easing the home-buying process. The programs, which were created to honor those who have served, may save you

Down Payment Assistance Programs

When thinking of buying a house, a first question is often How much do I need for a down payment? Ideally, a down payment is 10 percent to 20 percent of the purchase price, which will reduce your mortgage and lower your monthly payments. But in reality, many buyers, especially

How to Purchase a Home With No Down Payment

The trend in home buying has moved away from large down payments. In fact, today’s average down payment is just 6 percent, with zero-out-of-pocket deals more common than you might think. Accumulating savings while working can be difficult, especially for young first-time buyers with large amounts of student loan debt

How the New Tax Law Affects Homeowners

Congress and the president passed the most sweeping tax law overhaul in a generation at the end of 2017. Let’s take a look at how the tax benefits of homeownership have changed and how the new law will affect you. Tax deductions before and after. The most significant change for

How to Score (and Keep) Good Credit

When shopping for a mortgage, one number, in particular, plays a major role — a good credit score. A higher number means you’ll be offered a lower interest rate, which means a more affordable mortgage. Here’s what you need to know about your credit score and a few tips on

It’s Getting Easier to Obtain a Mortgage

The housing crash of 2008 led to a tightening of mortgage lending standards. Now rules are loosening again. What can you expect when applying for a loan to buy a house? Is the Water Just Right? Mortgage lending rules are loosening slightly because of both a slowdown in the number

Growing and Using Your Home Equity

The housing market continues to improve nationally through the current crisis. Industry forecasters expect pent up demand and low supply to push home prices higher in the months to come, even at historically low mortgage interest rates. If you already own a home, you’ve got an asset with intrinsic value

If You’re a First-Time Home Buyer, Don’t Panic, Get Help!

Buying a first home is a rite of passage. After crunching the numbers, receiving preapproval for a mortgage and finding a trustworthy agent, you’re ready to go house hunting. To make the adventure less daunting, check out these programs to help accomplish your goal of homeownership. FHA Loans The Federal

Should You — or Shouldn’t You — Refinance the Mortgage?

Are you in the market to refinance your home? Before signing any paperwork, it’s best to do your homework. Work the numbers. The top reason for refinancing is to obtain a lower interest rate. Depending on the terms, this could save you several hundred dollars a month. Those savings add

How to Accommodate FHA Home Buyers

Nearly 30 percent of home buyers today are using loans secured by the Federal Housing Administration or FHA — reason enough for home sellers to consider making their homes FHA-friendly. Here are a few tips to help understand the FHA process. Lending limits. Head to HUD.gov to see if your

Become a Houseopedia Insider

Receive weekly inspiration, tips, and advice all about the home!