Category: Mortgage

When to Lock In — Or Float — a Mortgage Rate

When applying for a mortgage, one of the first decisions a buyer must make is whether to lock in an interest rate on a mortgage. It’s somewhat of a gamble, but can be less stressful by paying attention to financial trends. How the process works. While shopping for homes, it’s

What are Green Mortgages and How Can They Benefit You?

If sustainable living is an important part of your lifestyle, you might be a candidate for a “green mortgage” when purchasing your next home or refinancing your current home. A little-known lending product, the green mortgage can save you big money while helping you live a more energy-conscious lifestyle. A

Tap Into Little Known Sources for Down Payment Help

Accumulating down payment money for a house is important, but can be challenging, especially for millennials bogged down in massive student loan debt. But don’t despair. Help is available through down payment assistance programs — in other words — free money. The Federal Housing Administration, or FHA, along with the

10 Ways to Help Repair Your Credit History

Do you have bad credit? While legitimate credit repair services can help improve your credit scores, you can do the work yourself and save money. Here’s how. Pull your credit report at www.annualcreditreport.com. It’s free. Each credit reporting agency, Experian, Equifax and Transunion, will have its own detailed report on

Qualifying for a Mortgage with Student Loan Debt

If you’re worried your student loans will prevent you from buying your first home, don’t fret. Here’s what you need to know to land that first house. What the mortgage company considers Your potential lender will look at your FICO score, which can range from 300 to 850. A score

How to Protest Your Property Tax Appraisal

If you received an unusually high property tax bill, don’t be afraid to fight back. Here’s how to effectively question your tax appraisal and file an appeal. Taxing authorities have two ways to boost tax revenue. One is to raise the tax rates. Typically, several local entities each has its

Home Equity Loan or Line of Credit: What is the Difference?

The equity in your home is an untapped resource for financing such things as remodeling projects or a child’s college education. Is it wise to take a home equity loan or a line of credit, and how do they work? The equity in your home — the value of your

When to Keep, When to Toss Those Important Documents

Ever wonder how long you should keep important documents such as old tax returns, mortgage documents, and home appliance receipts? Here’s a list of what to keep and when it’s safe to shred. Tax records. The IRS advises keeping tax returns and supporting documentation for at least three years —

Financial Tips For Buying A Fixer-Upper

If your dream home is a fixer-upper, but cash is tight, a 203 (k) program offered by the Federal Housing Administration could make ownership a reality. Known as FHA Section 203(k) insurance, the program allows buyers to finance the purchase of a distressed property and the cost of renovations through

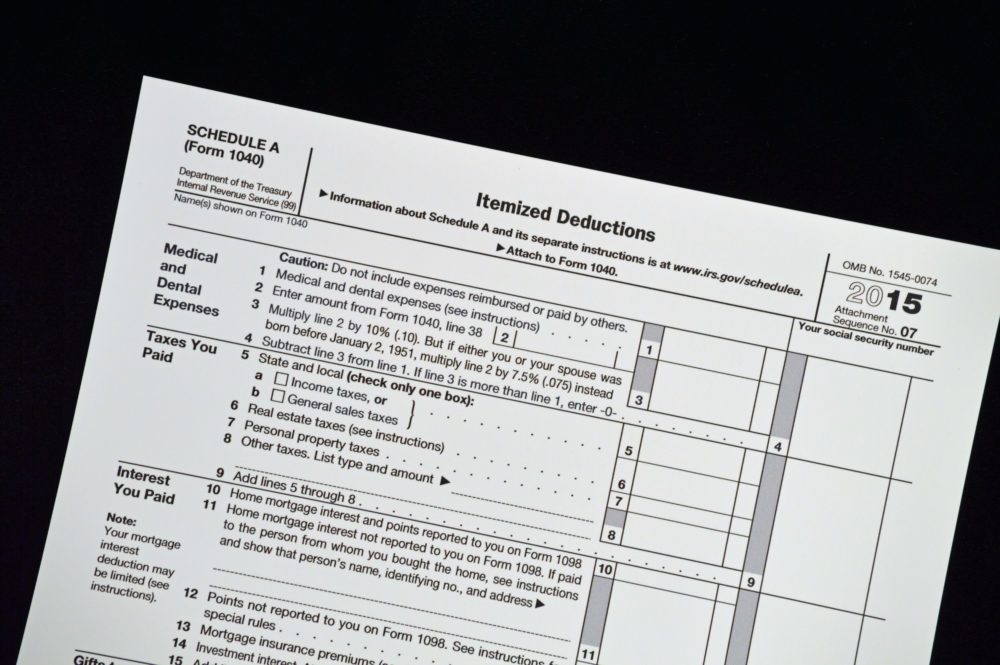

Tax Benefits of Homeownership

For most people, their home is their biggest investment — and their biggest tax benefits. As always, it’s best to consult your tax adviser for specific information, but let’s walk through the most common, basic tax savings of homeownership. Income Tax Savings When you file your federal income taxes each

What You Need to Know About Points and Origination Fees

When buying your first house, the terms and conditions of the mortgage process can be confusing. Here’s a primer on two such terms: points and the origination fee. Origination fee. This is the cost that the mortgage company charges you for borrowing money. When you take out a mortgage, it

Primary and Secondary Mortgage Markets: What’s the Difference?

When you buy a home, your mortgage is sold to you by a banker or broker on the primary mortgage market. When that first lender sells your mortgage to another firm, your mortgage enters the secondary market. Does it make any difference to you as a consumer? Primary mortgage market.

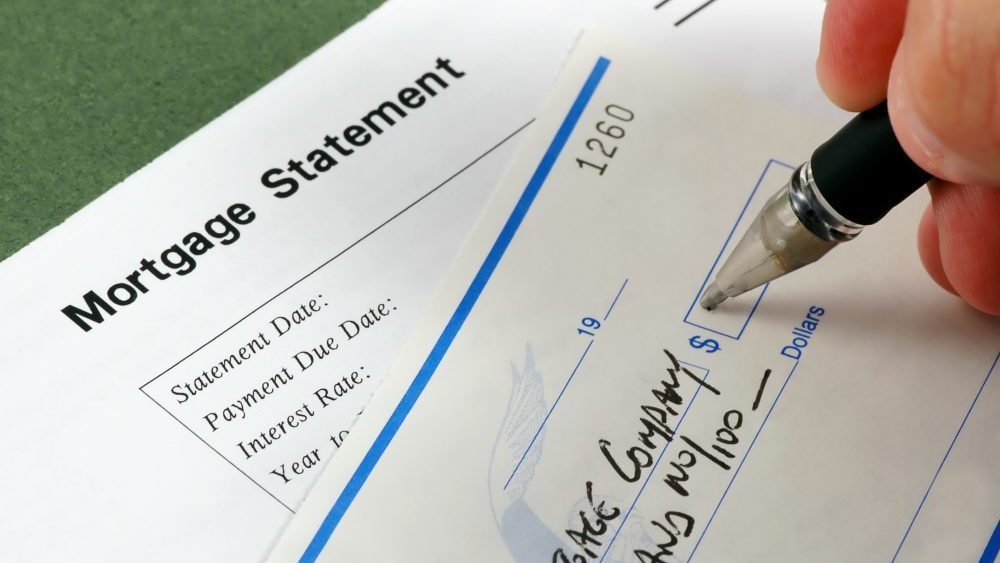

An Inside Look at Your Monthly Mortgage Payment

Each month you send off a hefty chunk of money to your mortgage company. If you’re like most people, it represents 25 percent to 30 percent of your income. That payment is split into as many as five parts. Take a look. The payment against the principal amount of the

Path to Homeownership: What is the Equal Credit Opportunity Act

Homeownership is the dream of millions of Americans, and should never be denied because of an applicant’s race, color, national origin, sex, religion, marital status or age. In 1974, Congress sought to remove such discriminatory obstacles from the approval process. The Equal Credit Opportunity Act was created to weed out

What Exactly is the Dodd-Frank Act and How Does It Help Consumers?

The financial crisis of 2008 started with shoddy mortgage-lending practices. Congress answered this problem with the 2010 Dodd-Frank Act, which was designed, among other things, to tighten mortgage lending standards and disclosures, keeping consumers better informed and curbing predatory lending practices. Here is a quick overview of what the Dodd-Frank

Simplified Loan Statements Make Choices More Clear

If you haven’t bought a home in recent years, the paperwork you’ll be confronted with will look a little different this time around. That’s because of new regulations put in place following the 2008 financial crisis. Under the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), the

Free Help for Consumers: ‘Know Before You Owe’

In the often-confusing world of finance, the Consumer Financial Protection Bureau (CFPB) is a valuable source of free information for homebuyers and others making a major purchase or investment. Created by Congress following the 2008 financial meltdown, the bureau provides helpful educational materials, tools for making financial decisions, and conflict

Choosing the Best Mortgage for You

Shopping for a home also means shopping for a mortgage. If this is all new to you, the multitude of mortgage types might be confusing. Here’s what you need to know. Fixed-rate mortgage. The fixed-rate mortgage is the most traditional way to finance a home. Typically available in fifteen- and

My Mortgage Was Sold — Now What?

It seemed like the ink was barely dry on your closing papers when you received notice that your mortgage had been sold to another company. While startling, it won’t change the terms of your loan. Here’s what you need to know. Why do mortgage companies sell mortgages? Mortgage companies lend

Become a Houseopedia Insider

Receive weekly inspiration, tips, and advice all about the home!